Convenient Medicare Supplements: Medicare Supplement Plans Near Me

Convenient Medicare Supplements: Medicare Supplement Plans Near Me

Blog Article

Exactly How Medicare Supplement Can Boost Your Insurance Policy Coverage Today

In today's facility landscape of insurance choices, the role of Medicare supplements sticks out as a vital part in enhancing one's protection. As people navigate the details of health care strategies and seek extensive defense, understanding the nuances of supplementary insurance ends up being significantly essential. With an emphasis on linking the gaps left by conventional Medicare strategies, these supplemental choices supply a customized approach to meeting certain demands. By checking out the advantages, insurance coverage alternatives, and cost considerations connected with Medicare supplements, people can make enlightened decisions that not only reinforce their insurance policy protection yet also provide a complacency for the future.

The Essentials of Medicare Supplements

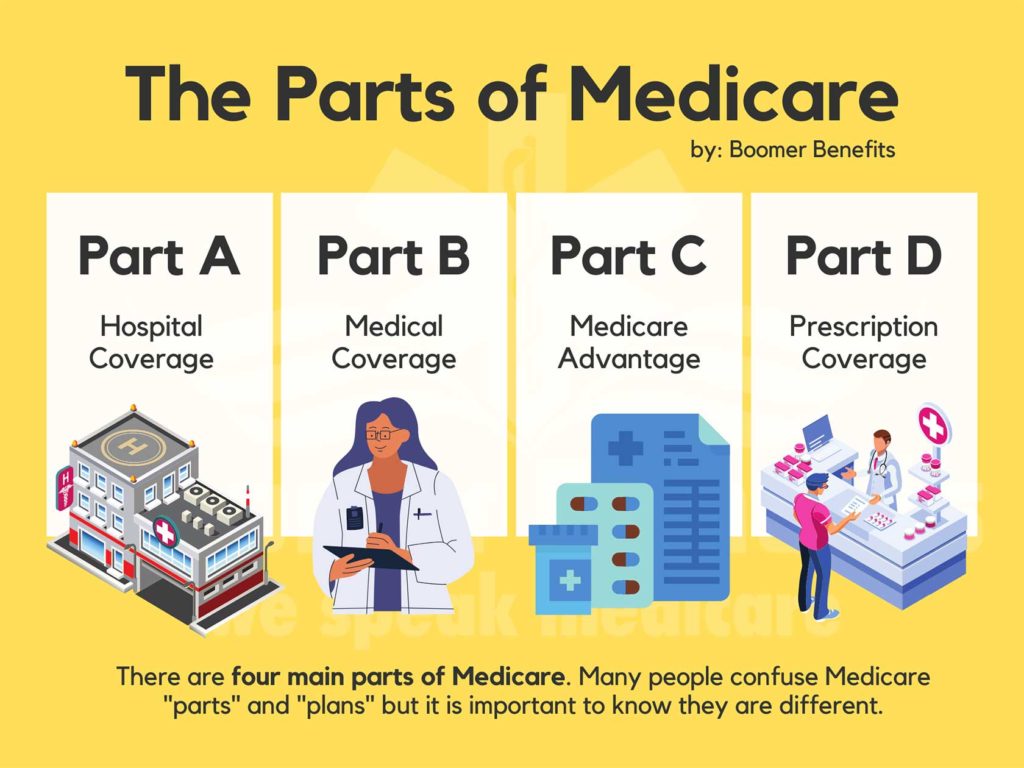

Medicare supplements, also known as Medigap plans, provide extra insurance coverage to fill the voids left by original Medicare. These auxiliary plans are provided by personal insurance policy companies and are created to cover expenditures such as copayments, coinsurance, and deductibles that are not fully covered by Medicare Part A and Part B. It's necessary to keep in mind that Medigap strategies can not be used as standalone policies but work together with initial Medicare.

One trick facet of Medicare supplements is that they are standard across most states, providing the exact same fundamental advantages no matter the insurance policy provider. There are ten different Medigap plans labeled A through N, each offering a different level of coverage. Strategy F is one of the most thorough options, covering almost all out-of-pocket costs, while various other strategies might supply extra minimal insurance coverage at a lower premium.

Understanding the fundamentals of Medicare supplements is important for people coming close to Medicare qualification that wish to enhance their insurance coverage and reduce potential monetary concerns connected with health care expenses.

Understanding Insurance Coverage Options

Checking out the diverse series of coverage choices readily available can supply valuable insights right into supplementing healthcare costs efficiently. When taking into consideration Medicare Supplement prepares, it is crucial to understand the different insurance coverage options to ensure thorough insurance security. Medicare Supplement prepares, likewise referred to as Medigap plans, are standardized across many states and identified with letters from A to N, each offering differing degrees of coverage. These plans cover copayments, coinsurance, and deductibles that Original Medicare does not completely spend for, giving beneficiaries with monetary protection and tranquility of mind. Additionally, some plans may use insurance coverage for solutions not included in Original Medicare, such as emergency care during foreign travel. Comprehending the insurance coverage alternatives within each strategy kind is important for individuals to choose a policy that lines up read this with their certain medical care demands and spending plan. By carefully assessing the coverage options available, beneficiaries can make informed decisions to enhance their insurance coverage and effectively manage healthcare costs.

Benefits of Supplemental Program

Comprehending the considerable advantages of supplemental strategies can brighten the value they bring to people seeking enhanced medical care protection. One essential benefit of supplemental strategies is the monetary safety and security they offer by helping to cover out-of-pocket prices that initial Medicare does not fully spend for, such as deductibles, copayments, and coinsurance. This can lead to significant financial savings for insurance policy holders, especially those that need frequent medical solutions or treatments. In addition, supplementary plans supply a wider series of protection alternatives, consisting of access to medical care providers that might decline Medicare task. This adaptability can be important for people that have particular healthcare needs or favor certain physicians or professionals. Another advantage of extra strategies is the ability to travel with satisfaction, as some strategies provide protection for emergency situation medical services while abroad. Generally, the advantages of supplemental plans contribute to a much more thorough and customized method to health care protection, making certain that individuals can receive the care they need without dealing with frustrating economic burdens.

Expense Considerations and Savings

Provided the financial protection and broader insurance coverage alternatives given by supplemental strategies, a critical facet to think about is the cost factors to consider and prospective cost savings they provide. While Medicare Supplement intends need a regular monthly costs along with the typical Medicare Component B premium, the advantages of lowered out-of-pocket expenses typically exceed the added cost. When examining the cost of supplementary plans, it is vital to contrast premiums, deductibles, copayments, and coinsurance throughout various strategy kinds to figure out one of the most affordable choice based on private medical care demands.

Additionally, choosing a strategy that lines up with one's health and financial demands can lead to significant cost savings over time. By picking a Medicare Supplement plan that covers a higher portion of healthcare costs, people can lessen unforeseen expenses and budget more successfully for clinical care. Furthermore, some additional plans provide family discounts or motivations for healthy actions, supplying further chances for expense savings. Medicare Supplement plans near me. Inevitably, investing in a Medicare Supplement strategy can offer useful economic protection and assurance for beneficiaries looking for extensive coverage.

Making the Right Option

With a selection of strategies offered, it is critical to examine variables such you could look here as insurance coverage choices, premiums, out-of-pocket expenses, supplier networks, and general worth. In addition, evaluating your budget restrictions and contrasting premium costs among different plans can aid make certain that you select a strategy that is budget friendly in the lengthy term.

Verdict

Report this page